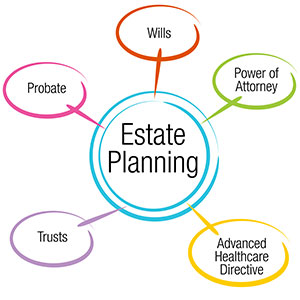

A Living Will Details The Health Care That You Want If You End Up On Life Support A living will, also called a health care directive, gives you the power to take control over what medical treatment you do or don’t want administered, in the event that you become unconscious or incapacitated. To learn more about health care directives, watch this short video. A Living Trust (also known as a revocable living trust) is created during an individual’s lifetime where a designated person, the trustee, is given responsibility for managing that individual’s assets for the benefit of the eventual beneficiary. A trust is a legal document that you create during your lifetime. Just like a will, a trust spells out your wishes with regard to your assets, your dependents, and your heirs. A trust can bypass the costly and time-consuming process of probate. This lets your successor trustee (who fills basically the same role as an executor of a will) to carry out your instructions as documented in your trust at your death. Your successor trustee also steps in if you’re unable to manage your financial, healthcare, and legal affairs…Read More

When it comes to COVID-19, there is so much that feels beyond our control. With estate planning (wills or trusts and more), there are things that you CAN control. Here is a list of things you can do (from an estate planning perspective) that may help you feel a little more in control: #1 During this COVID-19 crisis, who are your emergency health care decision makers? Talk to your loved ones about your wishes regarding your medical care. First, who would you want to step up to advocate for you during a health care crisis? The two parts of Health Care Directives are the Designation of Health Care Surrogate and Living Will. With the Designation of Health Care Surrogate, you nominate someone you trust to make health care decisions for you in the event that you are unable to communicate those decisions yourself. With a Living Will, you can include directions regarding end of life decisions, as well as other decisions about your care and treatment. #2 Look for your HIPAA Authorization. Your Health Care Directives should also include a HIPAA Authorization. HIPAA Authorization language follows the requirements Health Insurance…Read More

Do You Need A Will (Last Will And Testament) Or Revocable Living Trust? How Do You Choose? Are you interested in a will or revocable living trust? Wills and trusts are useful estate planning tools. They serve different purposes and can even work really well together. First, let’s go over key differences between wills and trusts. Will Characteristics: A will goes into effect only after you die. It only covers property that is in your name at your death. A will passes through a court process called Probate. The Probate court oversees the will’s administration and ensures the will is valid and that the property gets distributed the way the deceased wanted. Because a will passes through Probate, it’s a public record. A will lets you name a guardian for your minor children. There Is A Good Chance That If You Care About How Beneficiaries Use What You’re Leaving Them Or Want Someone Else To Manage It, You’re Going To Need Some Type Of Trust The two main types of trusts are testamentary trusts and revocable living trusts. One type of trust is inside your will and the other type…Read More

Do You Have A Revocable Living Trust? Will Your Family Have To Go To Court And Lose Their Valuable Privacy? Whether You Own A Little Or A Lot, You Need To Be Careful With Your Revocable Living Trust Do you have a revocable living trust as part of your estate planning? A solid estate plan can mean the difference between an expensive time in court or a smooth transfer of property for your family. When a high-profile celebrity passes away, we can learn a lot about the value of careful planning. Let’s take a look at what trust funding is and why it’s important. This Failed Estate Plan Is An Excellent Example Of Why You Need Properly Transfer Property To Your Revocable Living Trust In our opinion, Carrie Fisher’s plan failed, because it didn’t keep her assets out of court and they didn’t pass privately to her daughter. While Carrie Fisher had a revocable living trust, she didn’t transfer all of her assets to her trust. That is why her Trustee had to file a petition in probate court seeking to have her assets transferred into her trust. This actually…Read More

Do You Have A Beneficiaries In Your Last Will And Testament, Life Insurance And Retirement Accounts? Here Are Some Important Things You Need To Know Beneficiaries Of A Last Will And Testament Have To Wait First, you use a Will (Last Will and Testament) to give assets to your beneficiaries, your beneficiaries don’t inherit automatically. Those beneficiaries will need to wait until the probate court process is over before they can inherit. In some cases, this can take many months or even years. If the estate is complex, the legal fees can deplete that inheritance. If avoiding probate is a top priority, consider a Revocable Living Trust as part of your estate plan. Go here to learn more about wills and trusts. Go here to learn more about avoiding probate. Your Last Will And Testament Does Not Control Your Retirement Plan And Life Insurance Policy Benefits Second, assets in a life insurance policy or retirement plan pass to your beneficiaries directly, bypassing your Will (Last Will and Testament). Your beneficiaries will receive these assets after completing a claim form. [CTACustomJohnsonbox] Minor Children Should Not Inherit Directly. Consider A Trust Don’t…Read More

How can we help seniors manage their finances? With these tips, seniors can manage their finances better. And if they ever need help, they can shift their financial management to someone they can trust. 1. Use direct deposit. First, use direct deposit for income form pensions, annuities, and Social Security benefits. Not only will this save a trip to the bank, it also avoids the risk of a paper check being stolen, lost, or forgotten. 2. Consolidate retirement accounts. Consolidating retirement accounts into fewer accounts may make it easier to evaluate and manage savings, as well as to take any minimum distributions that are required. Also, when moving money between retirement accounts, it’s a good idea to use a trustee-to-trustee transfer rather than moving the money yourself. 3. Consolidate financial accounts. It can be a lot easier to manage your money when you have your money in fewer accounts at one bank. But make sure to consider the FDIC insurance limits on money held at one institution before consolidating. 4. Pay bills automatically. For recurring bills, have the biller automatically deduct payments from a credit card or bank account each…Read More

Are you a senior worried about identity theft? Or are you worried about a loved one with dementia becoming a victim of identity theft? Here are some tips on freezing someone’s credit. This is important if you’re trying to protect someone from elder abuse. What Does It Mean To Freeze Credit? A credit freeze restricts access to your credit report, making it harder for identity thieves to open new accounts in your name. To Place Or Lift A Credit Freeze, You Must Contact Each Credit Bureau Separately. Equifax: equifax.com or 800-695-1111 Experian: experian.com or 888-397-3742 TransUnion: transunion.com or 888-909-8872 Once a credit freeze is in place, it secures your credit file until you lift the freeze. You can do that online, by phone, or by mail using the special PIN the companies give you when you do the credit freeze. Once you place the credit freeze, it secures your credit file until you lift the freeze. You can unfreeze credit temporarily when you want to apply for new credit. Does It Cost Anything To Freeze Credit? No. Placing or lifting a credit freeze is free. Once a credit freeze is…Read More

There Is A Lot More Than Just Price That Goes Into Choosing Legal Documents Or The Lawyer That Will Help You When you’re comparing our fees to your other options, I encourage you to really understand what you are actually getting for that price. If you use an online form, you might actually cause your family a lot of headache and heartache down the road. So you want to find a lawyer that can draft you excellent legal documents in accordance with the state laws that captures everything that you want to see about how your assets go to your loved ones under what circumstances, who’s in charge. In My Office, We Create Relationships With My Clients Instead Of Just A Transaction That is because your estate planning should stay up to date with your life and with the law as it changes. So that your documents, so that when it matters most, your documents work. In my office, we analyze our client’s situation and goals and what we need to do to get them there. [CTACustomJohnsonbox] We Charge A Flat Fee Agreed To In Advance. That Way There Are…Read More

Start with reviewing the following documents at least once this year. 1. Estate Planning Documents To help ensure that your property and money ends up where you want it, look over your will, trusts, and other estate planning documents at least once a year to see if there is anything you’d like changed. For example, you may want to make a change if you’re recently married or divorced, added a new child to the family, received an inheritance, or experienced any number of other major life events. Or you may simply want to make a change because you’ve changed your mind about some part of your estate plan. Review your choices for who would manage your finances and health care if you ever become incapacitated. Are you still satisfied with your choices? We can update your documents for you, as well as review them to see if adjustments are needed due to any changes in the tax laws. How much does an estate plan cost? 2. Life Insurance Policies Things can change quickly in life, and the life insurance coverage that was sufficient to protect your family five or ten…Read More

Life insurance is an important part of estate planning and taking care of the people you love after you pass away. Here are some common mistakes that you should avoid. 1. Not Naming A Beneficiary Too many people forget to name a beneficiary or backup beneficiaries. Those mistakes can result in your life insurance proceeds having to go through the probate court process. That can tie up your money for months and even open up the life insurance proceeds to your creditors. And that can wipe out your funds. 2. Naming An Individual As Beneficiary To Take Care Of That Money For Someone Else You might be tempted to list someone you know and trust as beneficiary of your life insurance, with the understanding that he or she would use that money to take care of another person that you have in mind. This could result in a number of problems. For example, you list your sister as beneficiary of your life insurance so that she can take care of your daughter. 3. Not Keeping Your Beneficiaries Up To Date Too many people forget to update their beneficiary designations. You…Read More