In this article, you can discover… The role and benefits of digital estate planning. The types of assets you can include in a digital estate plan. How an attorney can help you organize and manage your digital assets. What Is Digital Estate Planning? Digital estate planning helps protect your digital assets, such as cryptocurrency, passwords, data stored in the cloud, and social media information. Digital estate planning ensures that people you trust can access and control your digital information if you become incapacitated or pass away. What Are The Legal Considerations For Digital Estate Planning? These days, you are strongly encouraged to include language in your will or trust to appoint a trustee or personal representative to have continued access to your digital information. An attorney can also help you understand and navigate…Read More

Do you own real estate? Is it your home? A vacation home? Or rental property? It’s important to pay special attention to how you own your real estate. Here we take a look at the different types of real estate and information about the best form of ownership. This is important when you’re thinking about estate planning and asset protection. Your Home Because your primary residence (your homestead) receives special tax treatment, be very careful with how you own your home. In states like Florida, tenancy by the entirety offers married couples creditor protection. This protection is from the creditors of one of the spouses while still preserving relevant tax benefits. It also allows automatic transfer of ownership to the surviving spouse upon the death of the first spouse without court involvement. Transferring…Read More

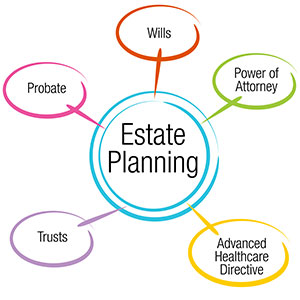

Where there is a Will, there is not always an estate plan. A Will is a good start, but you need more. First, a Will allows you to do the following: Direct who inherits your property after your death Nominate an executor (personal representative) to administer your estate Nominate legal guardians for your minor children Second, a Will does not complete your estate planning For example, a Will is limited to what happens upon your death. What if you get very sick or become incapacitated? A Will is not going to allow your family or other trusted people to help you manage your finances, legal matters or your health care. At the very least, a proper estate plan should also include the following: 1. A way for someone you trust to manage your…Read More

A Living Will Details The Health Care That You Want If You End Up On Life Support A living will, also called a health care directive, gives you the power to take control over what medical treatment you do or don’t want administered, in the event that you become unconscious or incapacitated. To learn more about health care directives, watch this short video. A Living Trust (also known as a revocable living trust) is created during an individual’s lifetime where a designated person, the trustee, is given responsibility for managing that individual’s assets for the benefit of the eventual beneficiary. A trust is a legal document that you create during your lifetime. Just like a will, a trust spells out your wishes with regard to your assets, your dependents, and your heirs. A…Read More

When it comes to COVID-19, there is so much that feels beyond our control. With estate planning (wills or trusts and more), there are things that you CAN control. Here is a list of things you can do (from an estate planning perspective) that may help you feel a little more in control: #1 During this COVID-19 crisis, who are your emergency health care decision makers? Talk to your loved ones about your wishes regarding your medical care. First, who would you want to step up to advocate for you during a health care crisis? The two parts of Health Care Directives are the Designation of Health Care Surrogate and Living Will. With the Designation of Health Care Surrogate, you nominate someone you trust to make health care decisions for you in the…Read More

Do You Need A Will (Last Will And Testament) Or Revocable Living Trust? How Do You Choose? Are you interested in a will or revocable living trust? Wills and trusts are useful estate planning tools. They serve different purposes and can even work really well together. First, let’s go over key differences between wills and trusts. Will Characteristics: A will goes into effect only after you die. It only covers property that is in your name at your death. A will passes through a court process called Probate. The Probate court oversees the will’s administration and ensures the will is valid and that the property gets distributed the way the deceased wanted. Because a will passes through Probate, it’s a public record. A will lets you name a guardian for your minor children.…Read More

Do You Have A Revocable Living Trust? Will Your Family Have To Go To Court And Lose Their Valuable Privacy? Whether You Own A Little Or A Lot, You Need To Be Careful With Your Revocable Living Trust Do you have a revocable living trust as part of your estate planning? A solid estate plan can mean the difference between an expensive time in court or a smooth transfer of property for your family. When a high-profile celebrity passes away, we can learn a lot about the value of careful planning. Let’s take a look at what trust funding is and why it’s important. This Failed Estate Plan Is An Excellent Example Of Why You Need Properly Transfer Property To Your Revocable Living Trust In our opinion, Carrie Fisher’s plan failed, because it…Read More

Do You Have A Beneficiaries In Your Last Will And Testament, Life Insurance And Retirement Accounts? Here Are Some Important Things You Need To Know Beneficiaries Of A Last Will And Testament Have To Wait First, you use a Will (Last Will and Testament) to give assets to your beneficiaries, your beneficiaries don’t inherit automatically. Those beneficiaries will need to wait until the probate court process is over before they can inherit. In some cases, this can take many months or even years. If the estate is complex, the legal fees can deplete that inheritance. If avoiding probate is a top priority, consider a Revocable Living Trust as part of your estate plan. Go here to learn more about wills and trusts. Go here to learn more about avoiding probate. Your Last Will…Read More

There Is A Lot More Than Just Price That Goes Into Choosing Legal Documents Or The Lawyer That Will Help You When you’re comparing our fees to your other options, I encourage you to really understand what you are actually getting for that price. If you use an online form, you might actually cause your family a lot of headache and heartache down the road. So you want to find a lawyer that can draft you excellent legal documents in accordance with the state laws that captures everything that you want to see about how your assets go to your loved ones under what circumstances, who’s in charge. In My Office, We Create Relationships With My Clients Instead Of Just A Transaction That is because your estate planning should stay up to date…Read More

Start with reviewing the following documents at least once this year. 1. Estate Planning Documents To help ensure that your property and money ends up where you want it, look over your will, trusts, and other estate planning documents at least once a year to see if there is anything you’d like changed. For example, you may want to make a change if you’re recently married or divorced, added a new child to the family, received an inheritance, or experienced any number of other major life events. Or you may simply want to make a change because you’ve changed your mind about some part of your estate plan. Review your choices for who would manage your finances and health care if you ever become incapacitated. Are you still satisfied with your choices? We…Read More