Call Now to Schedule Your Free 15 Minute Discovery Call

Compassionate Estate Planning & Trust Administration Lawyer in Tampa, FL

We Understand Your Problems And Want To Help You And Your Family.

When your family faces a legal challenge, you need to feel that your lawyer understands your problems and has your best interests in mind. We understand that your legal issues aren’t just another “case.” They’re real-life issues that can have a huge impact on your life and on your loved ones. That’s why we’re dedicated to providing you extraordinary guidance and support with your estate planning, elder law and probate/estate administration needs.

You Deserve A Well-Designed Estate Plan.

Many people assume that estate planning is just for people who are wealthy or old. But estate planning is for everyone. Believe it or not, most people have an estate. Your estate consists of everything you own, such as: your car, home,

bank accounts, investments, life insurance, retirement accounts and personal possessions.

Estate planning is about making sure that when you get very sick and can’t manage your healthcare or finances, the right people can step in to help you. And it’s also about making sure that after your death, your property or assets goes to the right people or organizations in a way that honors your wishes.

No matter how large or modest your estate is, our law firm takes great care to understand your goals and concerns. We also help you see where you stand with your current estate plans or within the state’s “default settings” for you and your family. And then we design a customized estate plan to address your goals and concerns.

Your estate plan may involve the strategic use of beneficiary designations, Wills, Trusts, Powers of Attorney, Health Care Directives and more. Such planning tools play a crucial role in ensuring that your wishes are honored and that your loved ones have a roadmap to follow during a medical crisis or time of loss. A well-designed estate plan will give you and your family peace of mind.

The Law Firm of Myrna Serrano Setty, P.A. is ready to help you with your estate planning, elder law and probate/estate administration needs. Are you curious about how to get started? Call us today to schedule your free Discovery Call.

Subscribe Now For The FULL Video

Schedule Your Discovery Call

About Myrna Serrano Setty

About Myrna Serrano Setty

Myrna understands the burdens that the legal process can place on families during times of stress and grief – especially when months-long court processes, financial burdens, and conflict between family members complicate already difficult circumstances.

Myrna’s experiences with families in turmoil have inspired her to take a collaborative approach to lifetime and estate planning. She understands the sensitive nature of many of the issues that families face. From managing the financial concerns of senior adults, to supporting parents with children who have special needs.

In addition to her legal training, she has a background in mediation and financial coaching. Attorney Myrna Serrano Setty has the skills to provide practical solutions in a compassionate and approachable manner. And by educating clients about their options, offering a variety of solutions, and providing valuable guidance and support, her firm can meet the needs of clients in a way that truly matters. Read more

Experienced And Compassionate Estate Settlement, Administration & Probate Attorneys In Tampa

There is no way to describe the feeling of losing someone you love. And the process of coming to emotional terms with a loved one’s passing is different for every person. So the last thing you need on your plate is the distraction of complicated legal matters.

Estate administration, settlement, and probate are all necessary functions of how the state of Florida ensures that a person’s assets, debts, and finances are properly distributed after their passing.

For many, the thought of estate settlement and probate is stressful and confusing. This is because there are so many issues that can arise – especially when you are faced with settling the estate of someone who has passed away without any Will or Trust in place…

What does it mean to be the executor of a Will in Florida? Can I avoid probate if my loved one had an estate plan? What does probate involve? These are just a few of the many questions that often flood in when it comes time to manage a person’s estate.

Luckily, The Law Firm of Myrna Serrano Setty, P.A. is here to help. From taking the stress out of the estate settlement process, to using our years of experience in probate law – we’ve got you covered. Our goal is to handle all the legal aspects that come up after losing someone so that you can focus on what matters. As your estate administration lawyer, The Law Firm of Myrna Serrano Setty, P.A. will make sure that you have a soft place to land.

Support for Executors of Florida Wills and Trusts

If you’ve been named the executor of an estate, you may consider reaching out to our firm to schedule your Discovery Call. Why? Because a probate lawyer or estate settlement attorney can help you feel confident that all of your responsibilities are seamlessly completed.

You don’t have to handle probate and settlement on your own – let The Law Firm of Myrna Serrano Setty, P.A. step in and take the burden of executorship off your shoulders. With our team at your side, you will have an experienced resource throughout probate and settlement.

Client Testimonials

“It was a pleasure to work with Myrna. She was kind, knowledgeable and very patient with all my questions. She took the time to explain everything to me step by step. She helped make the estate planning process a breeze.”

– Lezli

What Is Medicaid Planning?

What Is Medicaid Planning?

In Florida, Medicaid can help pay for long-term care, such as home health care, assisted living facility care or skilled nursing home care.

Most people do not realize that Medicaid is not just for the poor or impoverished. In many cases, our clients who need Medicaid planning are middle class or upper-middle class people who have saved their entire lives for retirement, only to be shocked at the exorbitant cost of long-term care. Through Medicaid Planning, we put together strategies to help our clients pay the high costs associated with long-term care, while protecting their assets. Read more

Subscribe To Our Newsletter

Please provide your name and email address to subscribe to our monthly newsletter.

Why Choose The Law Firm of Myrna Serrano Setty, P.A.

We understand that there is no higher priority than protecting the people you love. We believe that the best way to achieve this is by taking proactive steps that secure the efforts you’ve already made and safeguard against life’s uncertainties.

For this reason and so many more, we would be honored to have the chance to work with you and your family through your estate planning, elder law, probate or estate administration issue. But please don’t just take our word for it. You can explore the free resources on our site to learn more. We invite you to schedule your Discovery Call to learn more about us and to see if we’re the right fit for you.

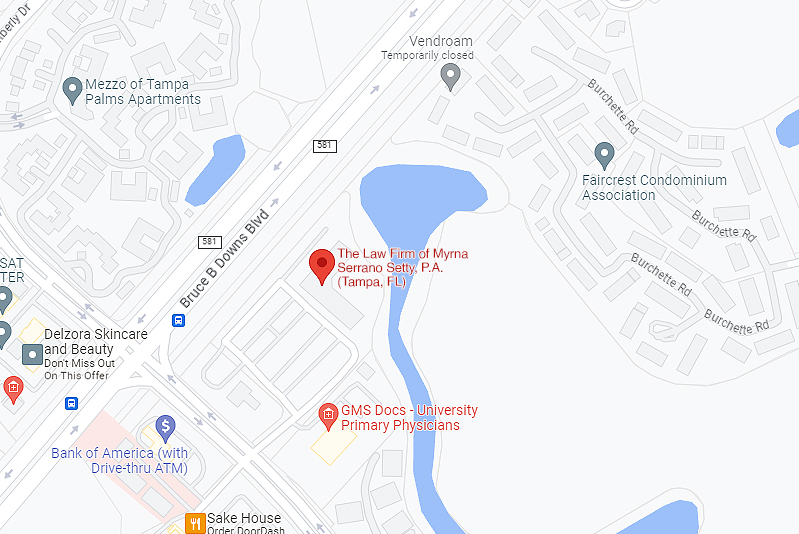

Office Location

(By Appointment Only)

15310 Amberly Drive

Suite 250

Tampa, FL 33647

Phone: (813) 686-7175

Business Hours are 9:00AM to 4:00PM

(By Appointment Only)

2236 Ashley Oaks Circle

Suite 102,

Wesley Chapel, FL 33544

Phone: (813) 686-7175

Business Hours are 9:00AM to 4:00PM

How To Find The Wesley Chapel Building?

- We’re in building 2236

- Look for the sign that says Ashley Oaks Business Center

Tampa location – On the 2nd floor suite 250

Look for the sign that says Regus